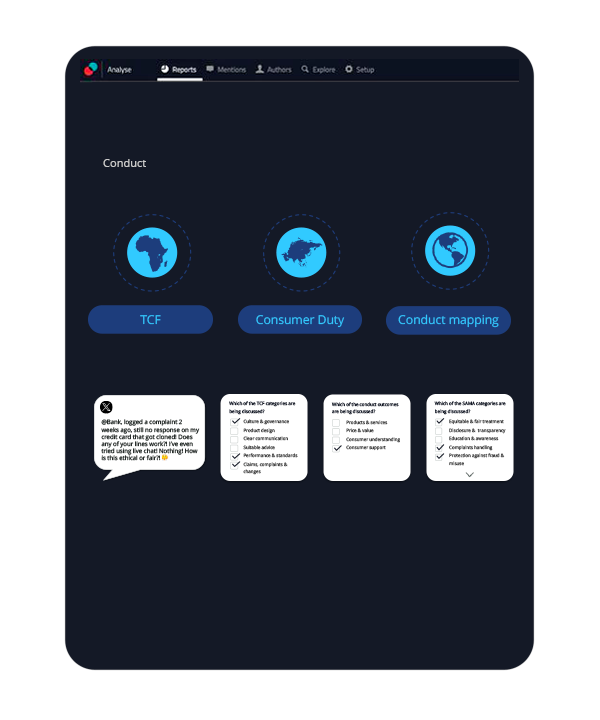

Regulators are increasingly demanding that entities with financial services provide consumers with communications they can understand, products and services that meet their needs and offer fair value and provide the customer the support that they need when they need it. Having worked closely with multiple regulatory frameworks, including the Twin Peaks model and the new Consumer Duty, DataEQ’s Conduct solution delivers comprehensive and automated conduct reporting for financial services using unstructured data sources.

Identify all conduct-related conversation

By identifying all of your conduct-related conversations online, financial service organisations are better positioned to demonstrate to regulatory authorities that fair outcomes are proactively and consistently delivered.

Get granular insights for swift issue resolution

Proactively understand consumer complaints to advance internal reporting and conduct root cause analysis of the issues that require action. This allows compliance teams to address conduct complaints before they are lodged with complaints authorities.

Map your internal data to regulatory outcomes

Through data mapping, DataEQ can use existing conduct, risk and topic themes to align data with firms’ internal frameworks. This means you can report on your internal organisational conduct standards and risk categories, including mapping internal standards to specific regulatory outcomes like the Consumer Duty or Treating Customers Fairly (TCF).

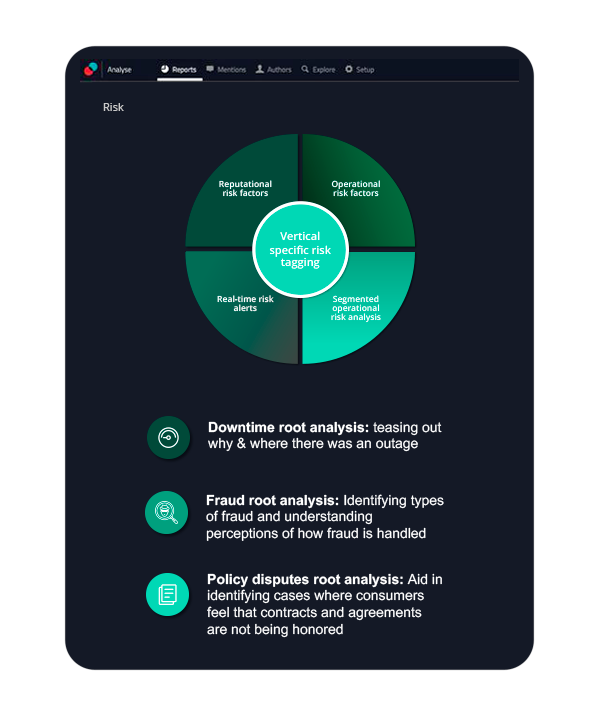

Customer feedback can include references to both operational and reputational risks to companies, possibly impacting their productivity, profitability or public standing. By risk tagging via the Crowd, DataQ can provide you with prioritisation for response, risk alerts, and reporting.

Categorise online mentions around potential risks

DataEQ identifies industry-specific risk factors in your online conversation. Social media is an influential and volatile space where reputational crises unfold rapidly. When these high-risk mentions surface, they can cause significant and lasting damage. We identify risk signals in their infancy before a crisis unfolds, enabling you to take early intervention.

Mitigate risk with an early warning monitoring system

DataEQ offers real-time alerts to notify you of emerging risks. This early-warning system empowers you to get ahead of any risk-related conversations before they escalate into PR or operational crises.

Granular insights for root cause analysis

DataEQ has created devoted financial services segments in the areas of fraud, downtime and policy disputes to give you a granular understanding of these high-risk topics. With these deeper qualitative insights, you can conduct root cause analysis of the issues that require action in the customer journey.

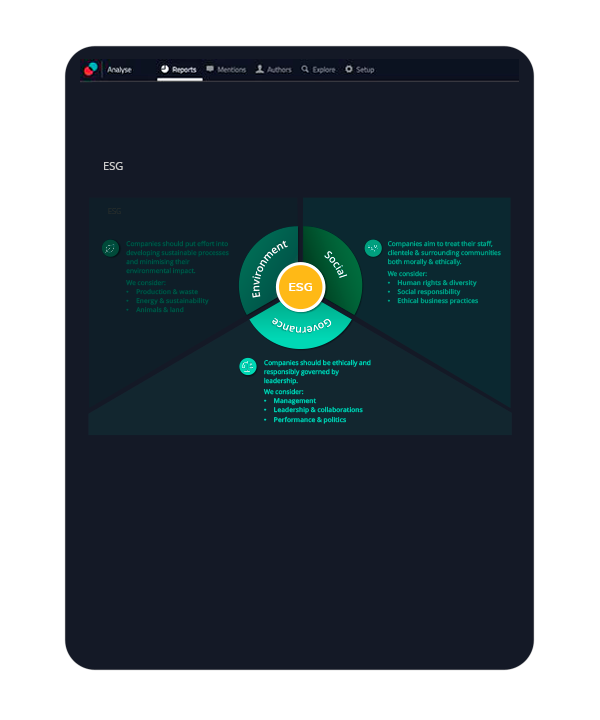

Navigating the ESG landscape is becoming increasingly complex, influenced by regulatory changes and rapidly evolving public sentiment. To streamline this process, DataEQ has developed a comprehensive framework to track and measure online ESG conversation.