Vodafone faces greatest churn threat

The 2019 DataEQ UK Telecoms Index analysed 194 546 tweets directed at the EE, O2, Three and Vodafone, from 1 February 2019 to 30 April 2019. The Index includes a churn risk analysis which focused on customers who threatened to quit their telecom providers.

This number represents a conservative churn risk, as it only includes customers who expressed an intent to cancel with their provider. The actual churn figure is potentially far greater with many unhappy customers choosing not to tweet their intent to find a new provider.

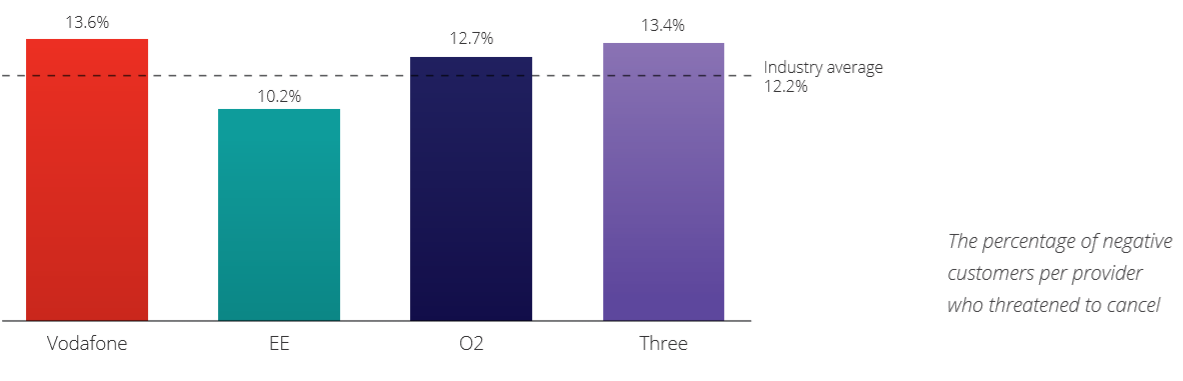

Vodafone recorded the highest percentage of negative customers discussing cancellation, 1.4 points above the industry average, followed closely by Three. EE’s share of customers talking about cancelling was the lowest, at 2 points below the industry average.

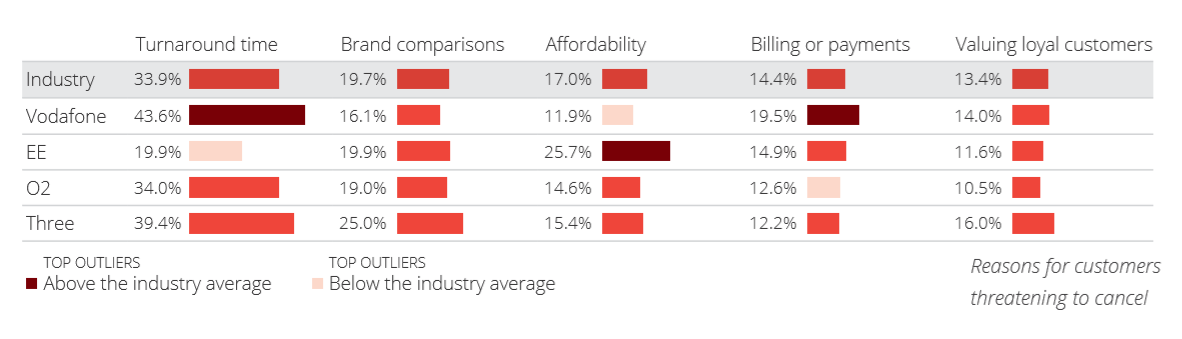

Among customers wishing to cancel with Vodafone, billing or payments complaints co-occurred with 25% of turnaround time complaints. Customers discussing both turnaround time and billing or payments reported that they struggled to get refunded after being overcharged and had a difficult time contacting the provider to cancel. Some customers refused payment, including cancellation fees, after failing to have their issue resolved by Vodafone.

Affordability was the most discussed topic among customers wishing to leave EE. In turn, frequent price increases were largely behind affordability complaints, as customers believed prices should remain the same as agreed in the sign up contract. Many of these customers also cited a competitor offering them a better deal as a reason for cancelling with EE. These customers felt they were being overcharged while also receiving subpar service. Some noted that EE’s ‘fastest network’ claim no longer justified their prices. Others noted that EE did not reward long term customer loyalty.

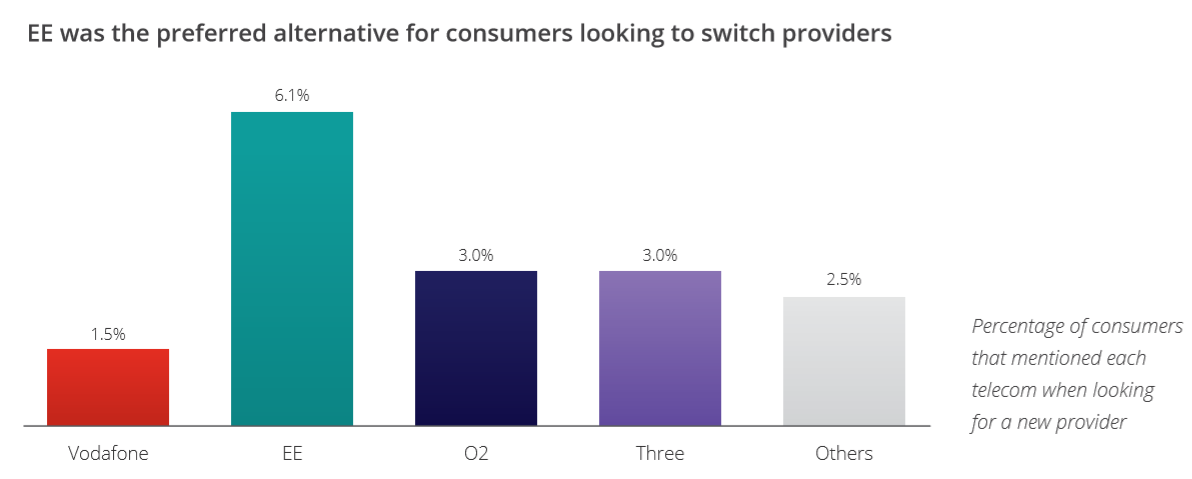

EE was the most cited alternative for consumers wishing to switch providers. The provider was mentioned twice as often as O2 and Three, and three times more often than Vodafone.

70.7% of all consumers that discussed switching to EE were O2 customers. Bad customer service, network quality, and lack of eSIM support were among the issues cited by O2 customers’ decision to move to EE. Consumers also considered MVNOs. 2.5% of all churn conversation mentioned at least one of the following MVNOs: Tesco, Virgin, Sky, giffgaff, TalkTalk, and Voxi.

Download the Index for a complete analysis of comparative sentiment performance, customer journey stages and channels for all four telecom providers.