Netflix streaming provider of choice in the Middle East

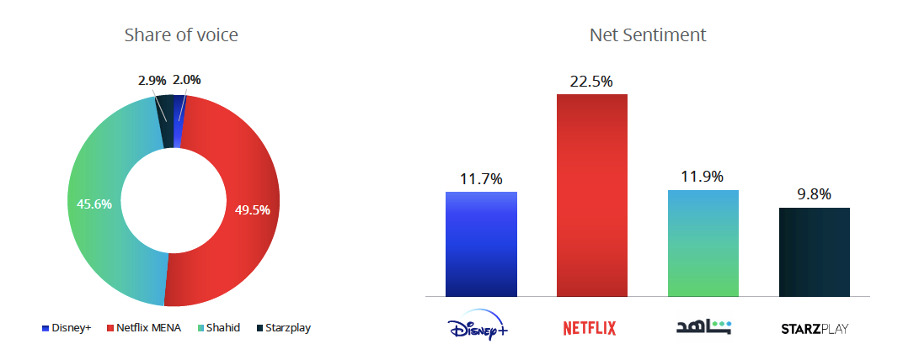

Content quality, consistent new show releases, and a diverse range of international and regional content are all factors that have resulted in Netflix MENA dominating the streaming services market in a new consumer-driven study conducted by data analytics company, DataEQ.

Having tracked over 1.1 million online posts about Disney+ MENA, Netflix MENA, Shahid and Starzplay from October 2022 to February 2023, the MENA Streaming Services Report uses advanced AI sentiment analysis techniques to gauge what viewers in the region value most in a streaming service, and which platforms garner the most consumer positivity online.

While Netflix MENA is currently a clear frontrunner, the full analysis uncovered several key strengths and weaknesses in each of the four streaming platforms’ service offerings. Given the radical growth predicted for the MENA region’s streaming market in coming years, now is the time for challenger platforms to get ahead.

“Compared to other, more developed streaming markets, the MENA region is still in its infancy, enabling competing platforms the unique opportunity to grow with a rapidly increasing demand for digital content consumption. This can be achieved by tailoring content according to current viewer preferences and demands,” comments Jamie Botha, Global Head of Partnerships at DataEQ

Regional content resonates with viewers

Regional content, for example, proved to be highly popular for the second-best performing platform in the study. Shahid’s high-quality Arabic content, such as Room 207 and Salon Zahra, really resonated with viewers, along with the platform’s popular reality TV shows, Z Raseedak and Stiletto. This is an area of content that shows great opportunity in the MENA region.

Sports coverage offers a potential one-up for Starzplay and Shahid

Another content category that has attracted subscribers in large numbers is live sports, which Netflix doesn’t currently offer. For Shahid, the Saudi League drew the highest volume of interest, while Lega Serie A was the most popular event for Starzplay.

“These platforms, however, need to ensure that they don’t run into widespread streaming issues, as instances of downtime during live matches caused a fair share of complaints among avid sporting fans,” says Botha.

Social customer service identified as a key opportunity

Finally, the study revealed that all four platforms fell short when it came to digital experience. When viewers ran into user issues, many would reach out on social media for assistance. These requests for support, however, did not always receive the attention they required.

“Interestingly, only Shahid and Starzplay actively engaged with social service requests,” notes Botha. “Considering the widespread use of social media across the region, this is yet another opportunity for streaming platforms to differentiate themselves in an increasingly competitive market,” Botha concludes.