The growing impact of Hellopeter on Net Sentiment

By Lisa Tuch, Senior Insurance DataEQ Analyst

This article was originally featured in Cover Magazine.

Since launching in 2000, online review platform Hellopeter.com has connected millions of South African consumers with local businesses. In addition to providing a public forum for consumers to share their experiences – both positive and negative – the free-to-use platform offers businesses the opportunity to read and respond to all reviews that are posted.

A common misconception, however, is that Hellopeter is just a cesspool of disgruntled ex-customers out to tarnish the reputation of hard-working businesses at any cost. Today, this couldn’t be further from the truth – at least for the insurance industry.

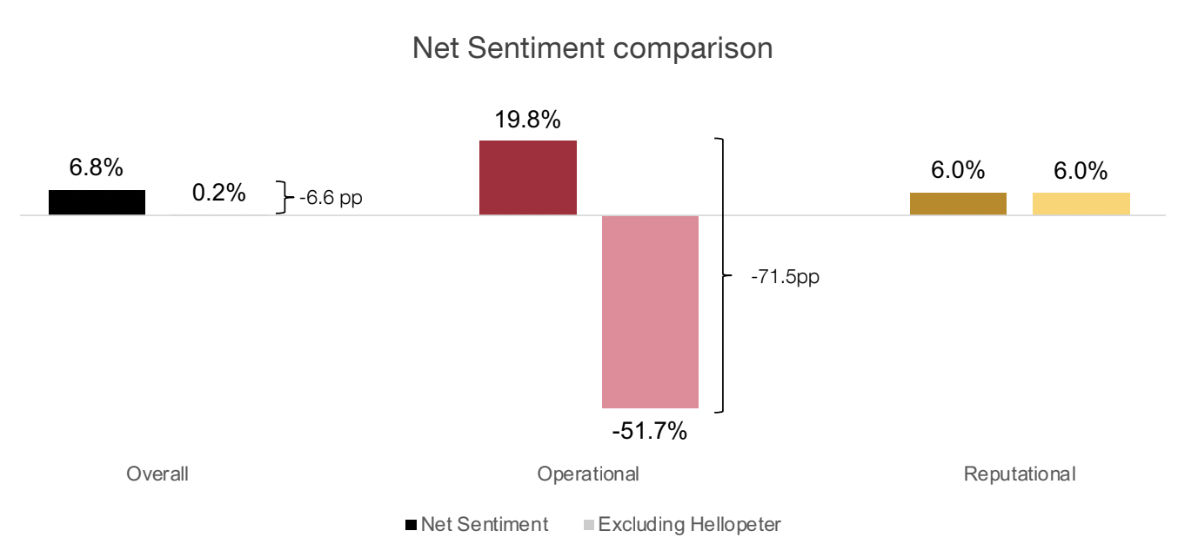

This is according to the latest South African Insurance Sentiment Index, conducted by PwC South Africa in collaboration with DataEQ, which showed Hellopeter data to have a significant positive impact on the aggregate Net Sentiment for the insurance industry. Approximately 11% of this year’s index data was posted on Hellopeter, and when excluded, industry Net Sentiment dropped by roughly 6.6 percentage points.

More than three-quarters (78.7%) of Hellopeter’s insurance feedback reviewed for the index was positive, while 21.3% was negative. When including neutral feedback, the platform netted out as a compellingly positive driver with a Net Sentiment of 56.9%.

Interesting to note is that operational conversation, which only includes unique non-enterprise mentions related to the customer experience journey, was impacted by Hellopeter data in a particularly positive way. This confirms that consumers’ posts on Hellopeter about their experiences with insurers were overwhelmingly positive.

While this was the case on an industry level, the impact of Hellopeter data did vary from insurer to insurer. Some were impacted positively by Hellopeter reviews, while others saw a negative effect. Some saw large differences, while others saw none at all.

Nevertheless, Hellopeter undoubtedly emerged as a significant source of insightful customer feedback for South African insurers across the board. The platform contributed roughly 34% of sentiment-bearing mentions, up from last year’s percentage of 27%. And if there is any doubt as to whether review platforms carry any weight, a recent study found that they influenced some $3.8 trillion in global e-commerce sales last year.

So, does this mean all businesses should incentivise employees and customers to post countless reviews in an attempt to game the system? Definitely not. Rather than trying to game systems and improve metrics, businesses should be focused on what matters – providing the best experience possible for their customers. Get this right, and the metrics will follow.