ESG an uncomfortable fit for UK’s fashion industry

The fashion industry has been under increasing scrutiny for its lack of transparency, particularly with the rise of “fast fashion” – trendy, cheaply made, and quickly discarded garments.

This practice has led to considerable environmental and social impacts. Widespread media coverage of this negative impact has sparked public discourse, fueled by consumer activism calling for boycotts on social media platforms.

The full extent of this conversation – and which brands shoulder the bulk of the responsibility – has been hard to quantify, until now.

DataEQ, in partnership with Relativ Impact, have just released the inaugural UK Fashion ESG Index in an effort to bring greater transparency to the industry and provide a new, consumer-driven perspective on the sustainability conversation.

The index tracked over 1.8 million posts from 1 January 2020 to 31 December 2022 to evaluate consumer social media conversation around the themes of environmental, social, and governance (ESG) related practices of nine leading UK-based fashion retailers.

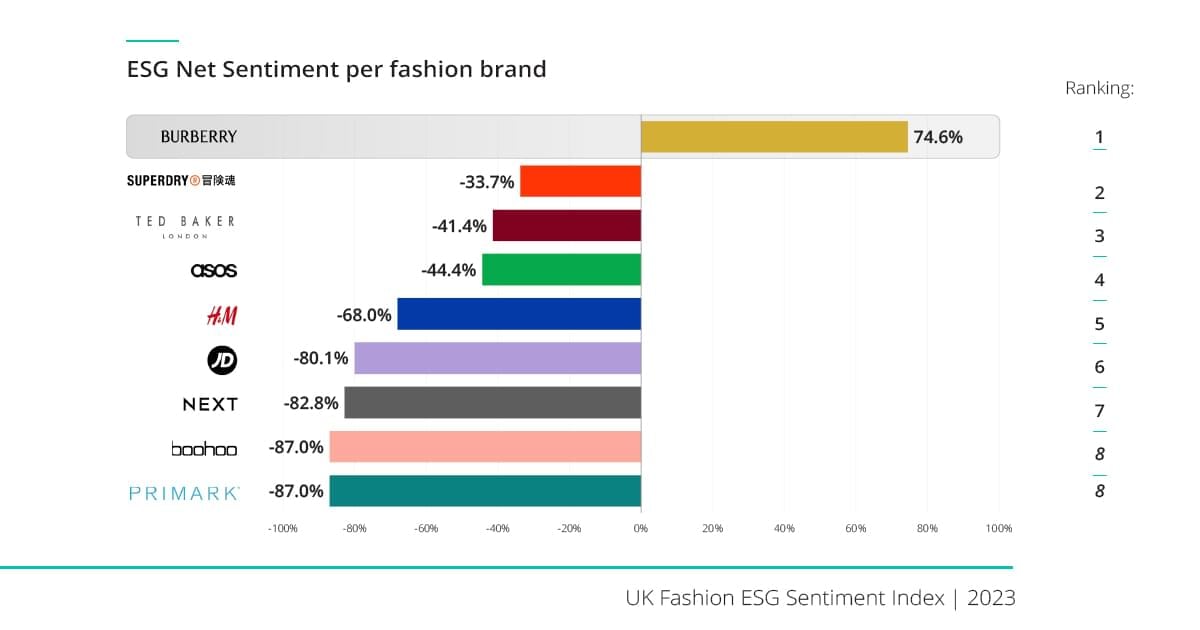

Burberry leads the pack in Net Sentiment, with Primark and Boohoo at the bottom

Analysis revealed that luxury label Burberry came out on top as the only brand with a positive Net Sentiment [1] of +74.6%, reflecting consumers’ strong appreciation of their ESG related practices. Burberry’s score is in stark contrast to the rest of the brands, where the average Net Sentiment was -63.8%. Notably, Primark and Boohoo sit tied at the bottom of the list, with a -87% Net Sentiment score.

Conversation around ESG concerns within the fashion industry is on the rise since COVID-19

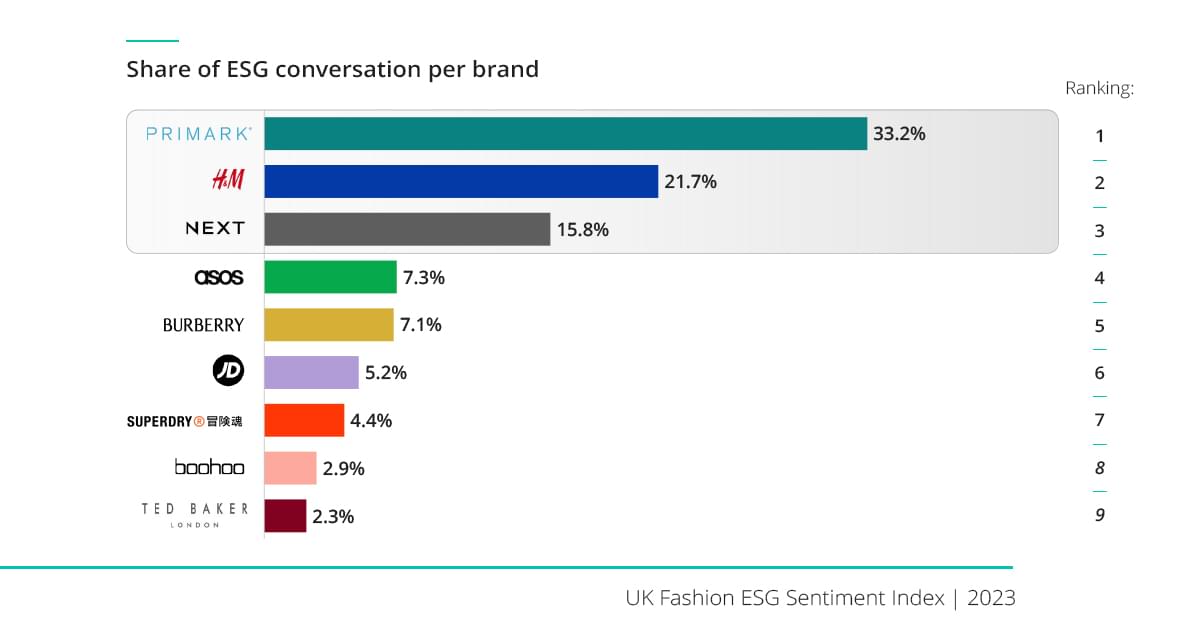

16.7% of all UK fashion industry conversation on social media related to ESG themes. Fast fashion brands like Primark (33.2%) and H&M (21.7%) had the highest share of this conversation.

The majority of conversations on ESG topics (76.9%) related to social considerations, with consumers’ health and safety being the most prominent topic. COVID-19 restrictions shaped social concerns for brands, customers and employees.

Governance-related conversation (64.5%) accused brands of putting profits above people. Posts highlighted the lack of ESG related policies, transparency, and accountability across the fast fashion industry.

Despite making up the smallest proportion of ESG conversation (12.2%), environmental considerations like animal cruelty were shown to cause major reputational harm to brands.

Fashion’s sustainable future: Uncovering the value of social data for ESG reporting

Melanie Malherbe, MD of DataEQ, highlights the value of social media as a tool to measure ESG performance. “The real value of social media as a data source is that it provides an honest unfiltered view of consumer opinion in real-time, showing what ESG issues matter most to consumers.”

Colin Habberton, CEO of Relativ Impact, echoes this sentiment from a business perspective, “Social media has become an indispensable source of stakeholder data for brands to inform risk assessments, gain an understanding of consumer interests and monitor stakeholder responses to their ESG claims and campaigns. It’s a goldmine of insights for investors too, supporting their decision-making and signals regarding brand reputation, consumer sentiment and behaviour trends regarding ESG risks without solely relying on the brands’ self-reported information.”

Melanie Malherbe continues, “Social platforms have provided a collective voice to millions of consumers who are concerned about the industry’s impact on the planet and society. It’s clear that social media will continue to play a crucial role in the journey towards more sustainable and ethical fashion practices. As this conversation evolves, it will be interesting to see how brands respond and adapt to these consumer expectations.”