Three Mobile tops UK social media study. Vodafone last.

Three UK has topped a sentiment analysis of UK mobile networks conducted by opinion mining company DataEQ. The study looked at social media conversation from May to July 2017 and tracked 447 263 posts relating to the networks, O2, EE, Vodafone and Three. The data were analysed in order to gauge how customers felt toward the networks and what factors were driving their sentiments.

According to a 2017 Deloitte Global Mobile Consumer Survey, 85% of adults in the UK use a smartphone with the figure expected to rise to 90% by 2020. As central a role as these devices play in our lives, we rely on mobile networks to provide us with the services that allow us to use many of our phones features. So how do customers of the four UK mobile networks feel about them? And what are the causes of positive and negative sentiment?

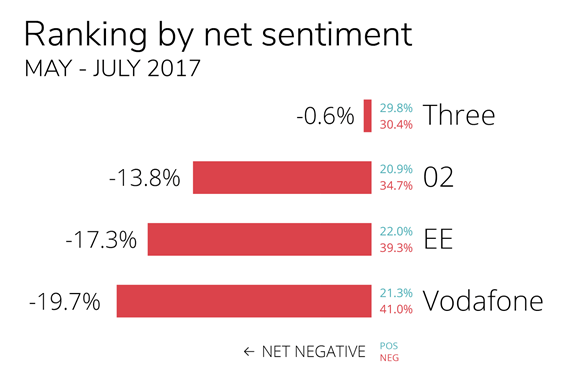

Mobile operators ranked according to overall net sentiment

Mobile operators ranked according to overall net sentiment

What were the main topics of conversation?

The most spoken about issue by customers referred to the availability of networks’ products or services, this made up 24% of all the conversation, nearly a third of which was negative. Much of this was about the availability of signal or network coverage, the lack of which was a point of great frustration for customers and contributed significantly to all providers’ negative sentiment.

What was positive conversation about?

Competitor comparisons and roaming

Positive sentiment arose in conversation where networks were positively compared to their competitors and in some conversation about roaming services. Both Vodafone and Three received high volumes of positive sentiment about their international roaming services, contributing to over 18% of their positive conversation.

Responding to customers

O2 and EE were the two most successful networks for customer engagement, both scoring over 70% on their response rates. Vodafone and Three did not fare as well, they had response rates of under 23%. Three had a low volume of consumer queries but Vodafone, who had almost 20 000 queries, only responded to approximately 2000.

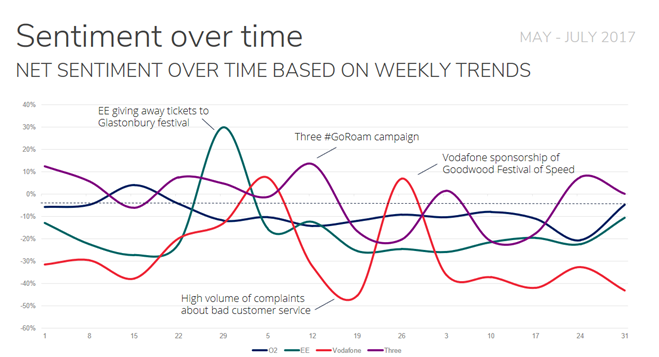

Weekly net sentiment towards mobile operators

Weekly net sentiment towards mobile operators

Campaigns – A driver of positive engagement

Customers engaged positively with networks’ promotional campaigns, sponsorships and giveaways such as Three’s #GoRoam campaign, O2’s #ShareAware, EE’s Glastonbury ticket giveaway and Vodafone’s CapitalSTB event, with the campaigns resulting in a spike in positive conversation.

What were the themes influencing sentiment towards the networks?

O2 Network coverage was the main reason for negative sentiment toward the service provider. O2’s sponsored #ShareAware campaign promoting online safety contributed to positive sentiment for the brand. One particular post on June 8 by the Ingham family on YouTube, had over 3 900 engagements.

EE Most negative conversation around EE related to access to services, in particular getting through to call centers roaming and signal. EE’s was most often cited as the preferred network to port to when consumers were feeling unsatisfied with their current provider.

Vodafone Poor customer service and problems with network coverage contributed to the majority of negative conversation for Vodafone. Customers also spoke about poor in-store and call centre experiences. The Goodwood Festival of Speed ticket giveaway contributed to positive engagement with the network.

Three Three’s #GoRoam campaign generated its highest volume (25%) of positive sentiment. Three was also the best performing provider when compared against other brands and was the most consistent brand based on weekly net sentiment.

Signal and network service issues were a prominent complaint area among Three users as well as the other providers in the study.

Social media data provides meaningful insights

Like many other subscription services, mobile network customers regularly take to social media to share their feelings about their services providers, sometimes directly engaging with them.

Mobile networks would be wise to seize the opportunity to utilise data from social media to understand customer and industry trends.