Telkom biggest winners in Vodacom data debacle

On 21 August Vodacom subscribers took to social media to complain that their data and air time had disappeared. The following day Vodacom apologised for the technical ‘glitch’ and announced that customers would be reimbursed.

According to a World Bank survey on the cost of data in Africa, South Africa has the fourth highest data prices of seventeen African countries.

In order to determine the drivers of sentiment toward major South African mobile networks, DataEQ tracked social media conversations around the #DataMustFall hashtag and Vodacom’s missing data glitch.

Before the ‘glitch’

From 1 to 14 August, prior to Vodacom’s glitch, DataEQ analysed conversation around the #DataMustFall hashtag. The analysis revealed that Vodacom was generating the highest percentage of negative mentions out of all the networks on the subject of data. Conversely, Telkom was the mobile network receiving the least negative conversation around the subject.

Disappearing data

On 18 August, Vodacom shared a link to an article dispelling the ‘myth’ of disappearing data on their Twitter account. In an ironic twist of fate, four days later Vodacom was forced to apologise for what they described as a ‘glitch’ that left many of its subscribers angry that their data and airtime had disappeared.

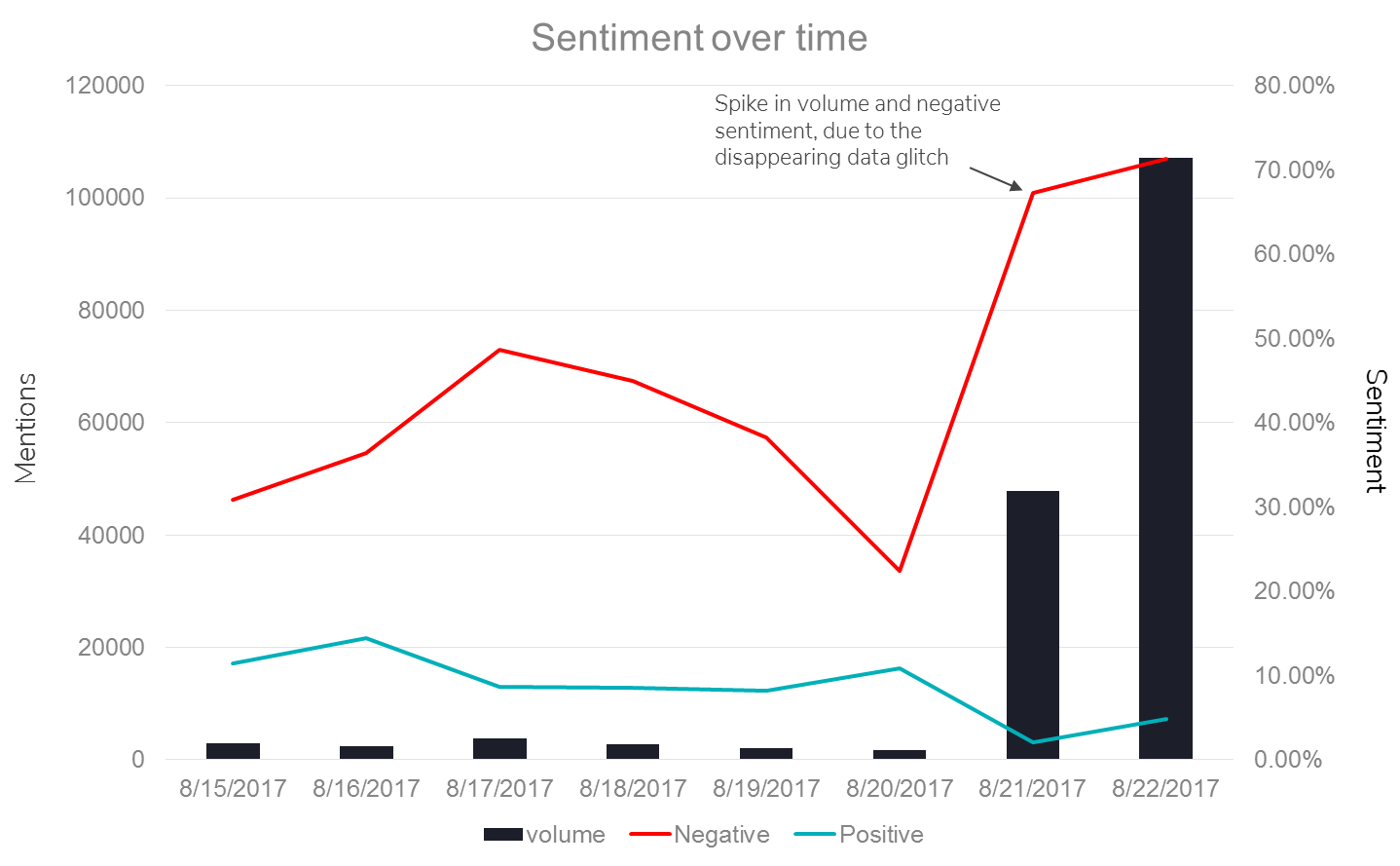

In order to measure the public response to Vodacom’s glitch, DataEQ analysed conversations from 15 to 22 August. Unsurprisingly, during this period 64% of all social media conversations pertaining to Vodacom were negative. The growth in negative sentiment from 20 August points to the missing data glitch as the driver behind the rapid rise in negative sentiment.

A number of high profile South Africans, including the Minister of Police Fikile Mbalula, Former Public Protector Thuli Madonsela, and commentator Eusebius McKaiser, took to Twitter to voice their criticism of Vodacom.

Telkom preferred destination

After Vodacom apologised for the glitch, over 1500 Vodacom customers directly expressed that they were planning on leaving, or that they had already left the network. As the data that DataEQ analysed was limited to the immediate aftermath of the debacle, it is likely representative of a much larger group of Vodacom subscribers who intended on leaving the network; 67% of wantaway Vodacom customers expressed that Telkom was their preferred porting destination. Telkom’s competitive data pricing was mentioned as the main driver of this.