Market conduct regulations spreading to social media

By Lara Sierra Rubia, Head of Analytics DataEQ

The South African government and regulators are ensuring that financial institutions place consumer interests at the heart of their business. Objectives around stability, financial integrity, financial inclusion and treating customers fairly (TCF) have been laid out in myriad policy discussion documents over the last decade. In July 2020, these proposals culminated in the Banking Conduct Standard, a series of customer-centric guiding principles that banks need to adhere to. The Standard encapsulates the core six principles of the Treating Customers Fairly framework and applies to all products offered by banks.

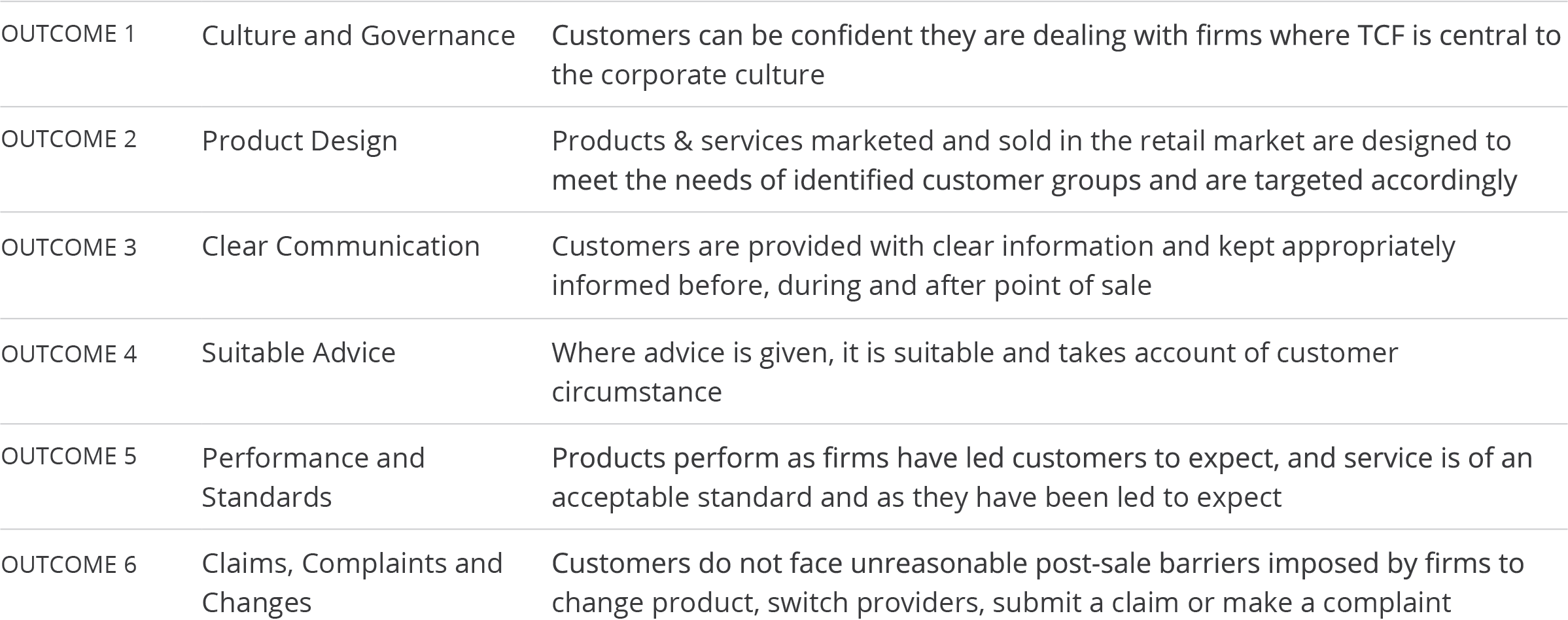

TCF outcome definitions

The Conduct Standard requires a radical shift in how financial institutions determine what constitutes a complaint. A complaint is defined by the Standard as “any expression of dissatisfaction”. Coupled with TCF outcomes, a complaint can pertain to dissatisfaction with the product design, product performance, the quality of the information provided by advertising or personnel, or the ability to change or cancel products with a financial services provider.

The Standard’s complaint definition implies that the mechanism for lodging a complaint is extremely wide. It does not limit complaints to formal channels like the Ombudsman. The Conduct Standard includes complaints made on social media, placing a large burden on financial services providers to capture, monitor, address and report on their compliance in handling TCF-related complaints online.

Considering the volume of social media conversation banks in South Africa receive, tracking complaints on these platforms is not an easy task to carry out. In 2020, DataEQ analysed over 2 million consumer mentions of banks on social media. This vast amount of online conversation is expected to grow with an increased uptake of digital communication on social media, not least as a result of the COVID-19 pandemic, but also due to financial institutions’ prioritisation of streamlining and automating their services. This raises the question: how will banks be able to pick out TCF complaints in an ocean of online conversation?

In response to the new regulatory requirements, DataEQ has developed an industry-first Market Conduct solution designed to help financial service providers navigate, identify and monitor TCF conversation and complaints. The Market Conduct solution segments consumer conversation into sentiment (positive, negative or neutral) and then assigns the six TCF outcomes to relevant mentions. This is done through a unique human verification layer which allows financial organisations to not only identify all high-risk complaints but structure them according to the TCF outcomes, something that until now has not been possible.

In order to address these complaints, one needs to link your data to a social customer service platform, such as DataEQ’s Engage, to help prioritise and then respond to TCF-related conversation. In order to make actionable strategic improvements and decisions with this data, a further layer of granularity is required to allow for root-cause analysis.

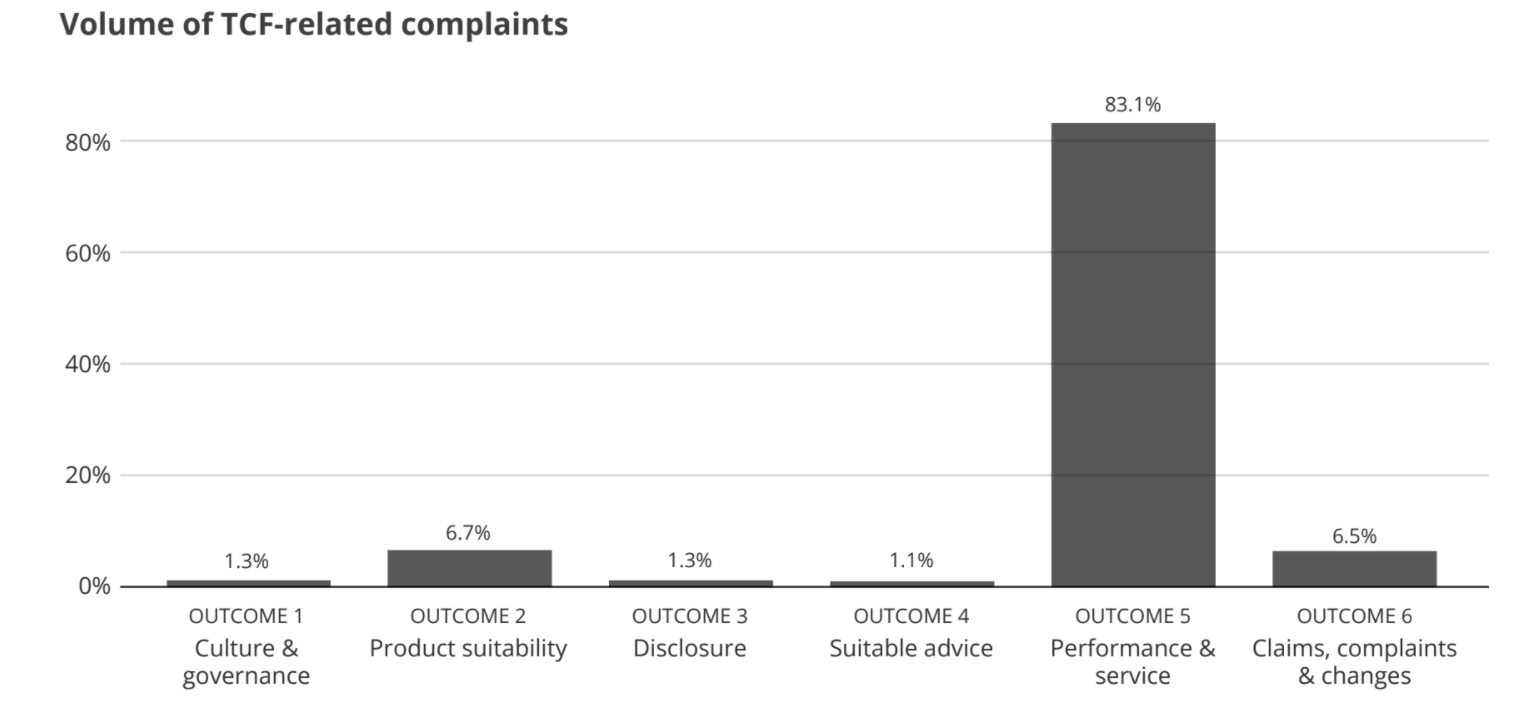

TCF Twitter volume breakdown from 2020 SA Banking Index

TCF Twitter volume breakdown from 2020 SA Banking Index

In addition to the Conduct Standard, the financial services sector is anticipating further outcomes-based legislation and regulations in the near term. The Conduct of Financial Institutions (COFI) Bill will be enacted into law in 2021, making TCF principles legally binding and enforceable on all financial institutions. This not only places an imperative on financial services providers to align their products, processes and services with TCF, but will also require monitoring and evaluation of how well they are executing on these principles. Banks, insurers and firms with financial service offerings will need to report on complaints related to the six TCF outcomes.

Companies will need to adapt to these increasing regulatory requirements to prove that they are indeed putting their customers first. DataEQ’s Market Conduct solution does not just allow companies to box-tick compliance requirements but enables a granular understanding of consumers’ needs, empowering strategic decisions that truly place customers first.