Improve social customer care or risk losing customers

By Nic Ray, DataEQ SA CEO

There are many exciting developments happening in SA retail banking. New entrants and apps with novel reward schemes are welcome additions for consumers but these innovations shouldn’t distract the banks themselves from the reality that consumers aren’t happy with their banks and in 2019 it’s only gotten worse. If the banks want to fix this, they’ll need to focus on getting the basics right first, affordability, customer service and better market conduct.

Pricing is key to new opportunities

According to DataEQ’s 2019 SA Banking Sentiment Index, consumers are looking for affordability. Capitec, the only bank to continuously maintain a positive Net Sentiment score over multiple years has capitalised on this with their fee reduction driving significant new acquisition opportunities.

Consumers alert to market conduct

This year, consumers have exhibited a heightened concern about market conduct, fraud and corruption. These reputational concerns go a long way in affecting consumer sentiment. Nedbank’s leading overall Net Sentiment score was heavily boosted by its CSI campaigns. Conversely, allegations against Absa and FNB were damaging to their sentiment. The negative consumer response to job cuts as a result of automation are indicative of future reputational risks that banks must navigate thoughtfully. But navigating reputational performance alone will not suffice. Consumers are just as concerned about operational efficiencies.

Growth of online complaints pose new risks

The greatest contributor to the growth of unhappy consumer sentiment is the increase in online complaints and customer service requests. South Africans are increasingly directing their complaints and service requests to the social handles of their banks, as they seek to publicly out the bad service they have received or speak directly with their bank in private messaging on Facebook and Twitter.

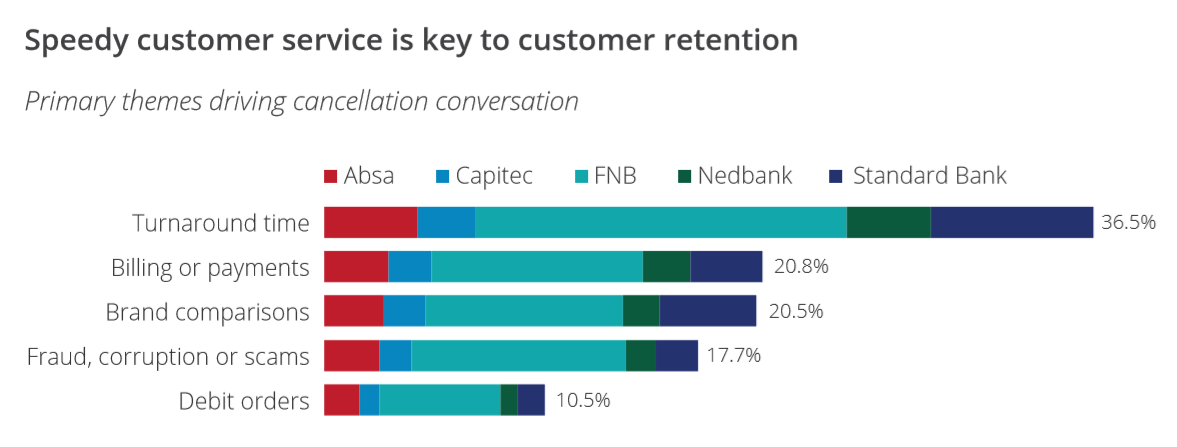

As the volume of this conversation increases, from onboarding enquiries to app complaints, banks will need to introduce systems that allow them to find, prioritise and resolve the most important customer interactions from the rest of the noise on social media. Banks that can adopt this approach stand to gain in loyalty and optimise retention. Those that do not can expect to see their clients switch banks. Responsive, reliable and quick customer service is critical. Turnaround time was the most cited issue by consumers who threatened to leave their banks. Capitec’s leading customer experience performance, in particular having the least complaints about turnaround time, saw them achieve the lowest risk of customer churn.

New opportunities in 2020

In 2020 all three of the new entrants are expected to be fully operational. As these new entrants grow their customer numbers they are likely to face an increase in online conversation. The optimism and excitement that paved the way for their long-awaited arrival will likely be tempered by growing service requests and complaints. Like the incumbents, the digitally focused entrants will also have to focus on finding and prioritising their most valuable customer interactions.

If they can get this right, together with a simplified product set, they will be poised to cause significant disruption.