Why South Africans dislike their ISPs

*Report available for download here

DataEQ has published its 2023 ISP Banking Sentiment Index, revealing how consumers feel towards seven of the country’s leading ISPs. The report tracked over 140,000 social media mentions to gauge public Net Sentiment.

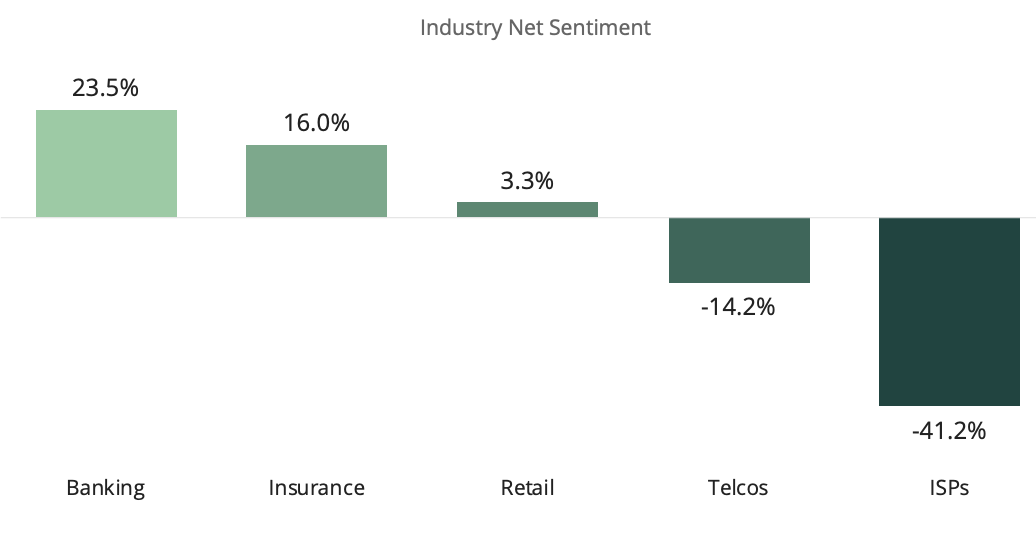

ISP is SA’s least liked industry

With an average Net Sentiment score of -41.2%, ISPs in South Africa are lagging behind other industries. In contrast, industries like insurance and banking have received more favourable Net Sentiments of 23.5% and 9% respectively. Even the often-criticised telecommunications industry fared better, posting a Net Sentiment of -14%.

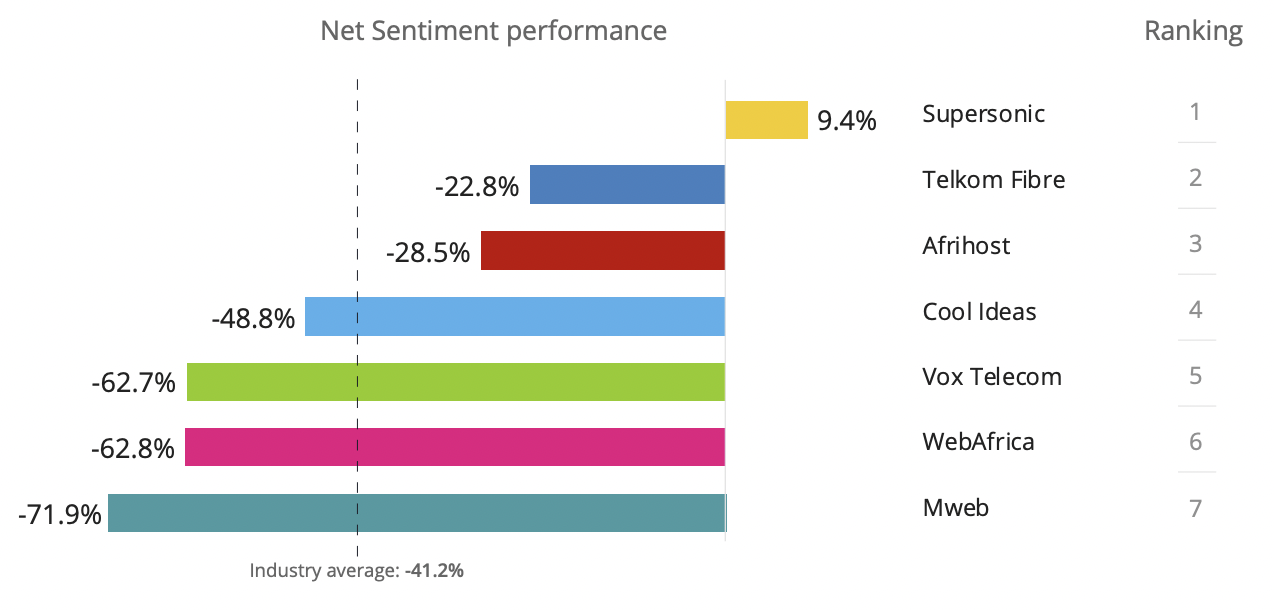

Supersonic SA’s favourite ISP

Supersonic stands out as the only provider with a positive Net Sentiment score of 9.4% with consumers praising it for its pricing and network reliability. This score was, however, heavily impacted by strategic campaigns aimed at driving consumer praise.

Telkom Fibre, the next best ISP, also utilised campaigns to boost its image, though this masked customer service shortcomings. Similarly, ISPs like Vox Telecom, Mweb, and WebAfrica were particularly hard-hit with service complaints and cancellation threats, substantial contributors to their poor Net Sentiment performance.

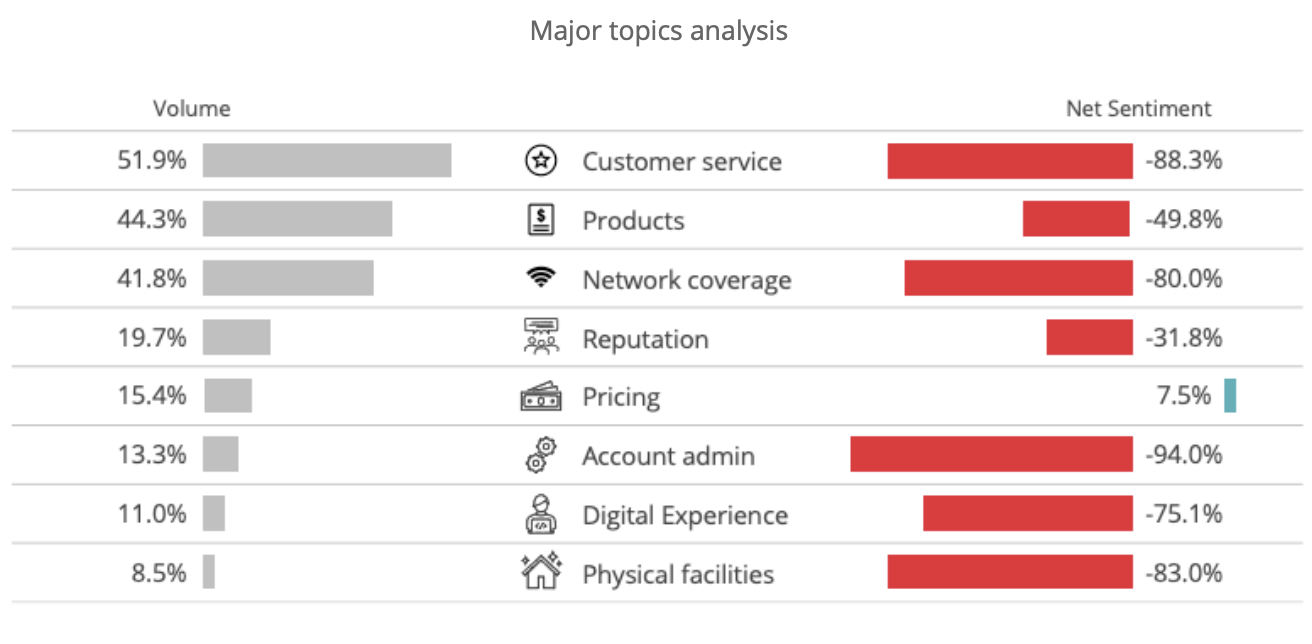

Customer service, product and network drive consumer complaints

Customers expressed frustration towards a range of issues, like delayed router installations, unreliable or intermittent internet connectivity, slow internet speeds, downtime and billing errors. Poor communication and unresponsive customer service further exacerbated negativity towards providers.

ISPs only respond to half of priority conversations

On average, 66.9% of ISP conversation warranted some form of action or attention due to mentions containing purchase opportunities, service issues, or cancellation threats.

Vox Telecom, Mweb, and WebAfrica had the highest percentage of actionable conversations, mostly driven by cancellation threats. Afrihost (43.7%), Supersonic (53.6%), and Telkom Fibre (58.1%) registered the least actionable conversations, denoting a higher proportion of campaign-driven “noise”, making it more difficult for service agents to identify actionable posts.

On average ISPs engaged with 50.2% of priority conversations. Supersonic delivered the quickest response time with a nine-hour average. WebAfrica had the highest response rate and relatively low response times but generally received poor customer service feedback.

Telkom Fibre and Mweb achieved the slowest response times of 26 and 64 hours respectively. Telkom fibre’s two and half day wait times significantly increased the industry average to just over 22 hours. Telkom Fibre also recorded the lowest response rate, effectively missing out on three quarters of potential actionable posts.”

The expectation gap in ISP service delivery widens

The industry-wide low Net Sentiment exposes a significant expectation gap. It’s clear that promotional campaigns can’t mask subpar service. Liska Kloppers, Head of Client Strategy at DataEQ, elaborates: “Price-sensitive consumers are lured by attractive packages, but this tactic backfires when service delivery fails to meet expectations. In today’s digital age, consumers expect ISPs to deliver on both price, network and service, and are quick to voice their dissatisfaction on social media when any one of these aspects fail to meet those expectations.”