South African banks top digital experience

*Report available for download here

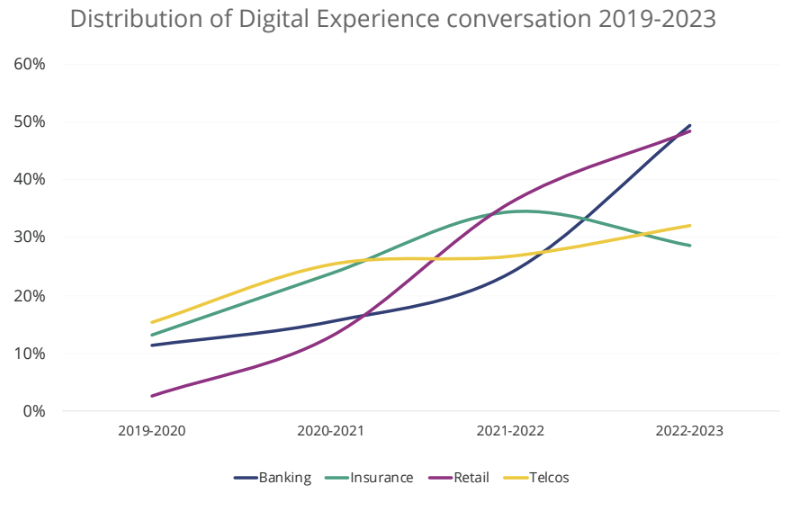

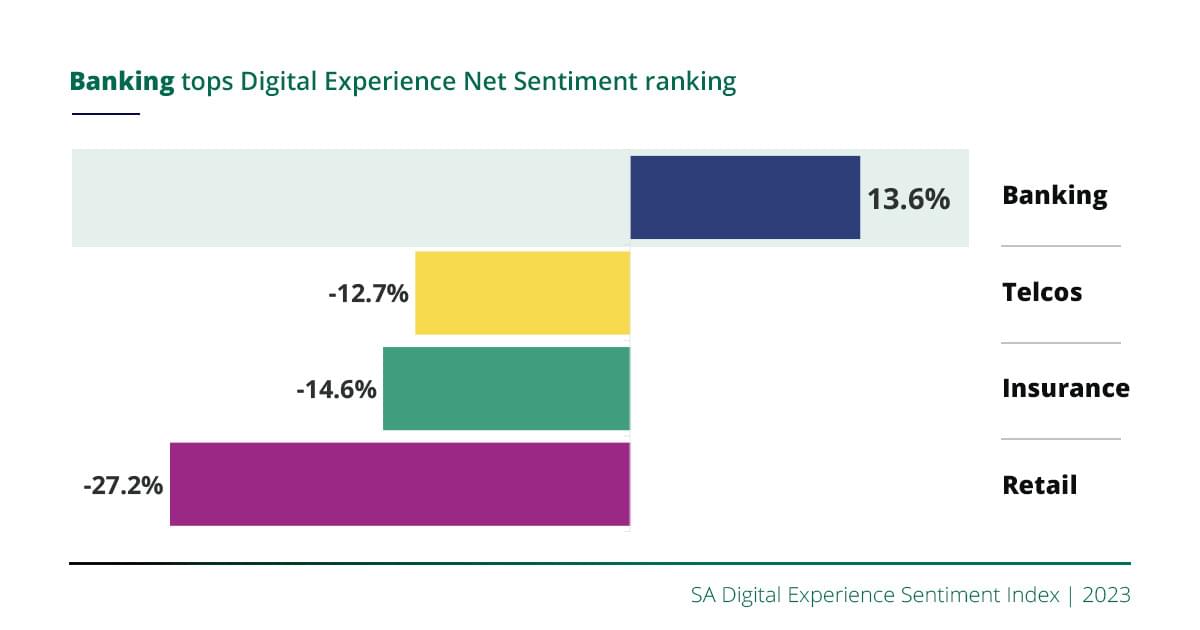

Between 2019 and 2023, conversation on social media relating to digital offerings saw a 29% rise in volume among South African consumers. Banks captured the lion’s share of voice and positive sentiment in this regard, attracting consumers with a range of secure and efficient digital services.

One standout feature driving the widespread adoption of banking apps was the integration of various services beyond the core banking functions. By consolidating services like the Lotto, rewards programmes, eWallets, virtual cards, and budgeting tools within a single app, users are empowered to streamline their financial activities and interactions.

On the other end of the spectrum, the retail industry recorded the lowest Net Sentiment score. While some consumers lauded the speed and convenience of retail apps, others reported issues with missing or expired items, subpar customer service and technical glitches.

A common positive theme across all four industries was the prominence of rewards and loyalty programmes. Effectively gamifying the experience, digital rewards and vouchers were used as key incentives to encourage customers to explore new app features or digital platforms. These included fuel cashbacks, healthy eating and living rewards, flight discounts, airtime, and data vouchers.

Despite the growing dominance of digital channels, traditional communication channels and human interaction remain valuable, especially in critical situations. This underscores the importance of striking a balanced approach, recognising that certain interactions still require a personal touch.

Nic Ray, CEO of DataEQ, notes that the growing role of generative artificial intelligence (AI) and machine learning offers exciting opportunities for more sophisticated digital experiences. “As these technologies progress, digital offerings will likely become even more anthropomorphic and refined, potentially replacing human interactions entirely in the future. However, until that day comes, maintaining the right balance between AI and human interaction is crucial for delivering seamless customer experiences”

This, Ray says, is where social data offers a valuable resource. “By providing real-time insights into consumer sentiment and trends, social data empowers businesses to tailor their digital strategies effectively.”

As South Africa continues its digital transformation, businesses that leverage social data to inform their digital strategies will be better positioned to meet the evolving needs and expectations of their customers. Digital experience remains paramount, and the integration of social insights can be a pivotal factor in achieving success in this evolving landscape.