KSA Banking Sentiment Index

PWC Middle East in collaboration with DataEQ has published the KSA Banking Sentiment Index, revealing how nine of the Kingdom’s leading financial institutions compare in the eyes of consumers on social media.

Industry average

0.1%

Net Sentiment score

Al Rahji dominates conversation

39.9%

Share of Voice

Industry response rate

56.9%

The nine Saudi financial institutes included in the analysis are Al Rajhi Bank, Alinma Bank, Al Bilad Bank, Banque Saudi Fransi, Riyad Bank, Saudi National Bank, Saudi Awwal Bank, Saudi Investment Bank and STC Pay.

The index tracked public X (formerly Twitter) posts mentioning these banks. These posts were then processed using DataEQ’s unique Crowd and AI technology to analyse sentiment and factors driving customer experience.

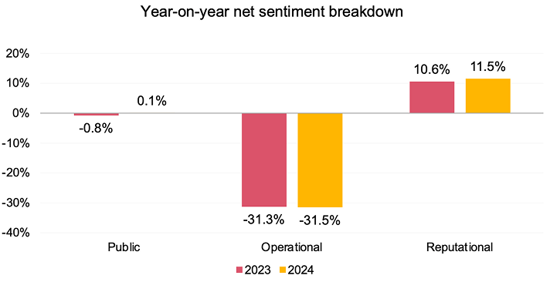

Despite consumers having a negative overall experience with their banks, the industry saw a slight improvement from 2023, while banks received praise for their reputational performance.

KSA Banking industry sees

0.9pp (percentage point)

improvement in Net Sentiment

Discover the key factors that are impacting customer sentiment toward UK's leading insurers