South African Banking Sentiment Index

DataEQ has published its ninth South African Banking Sentiment Index, revealing how eight of the country’s biggest banks compare in the eyes of consumers.

Top performer:

Discovery Bank

47%

Net Sentiment score

Most negative channel:

Call centre

-89%

Net Sentiment score

Proportion of conversation linked to

Downtime:

54%

Net Sentiment score

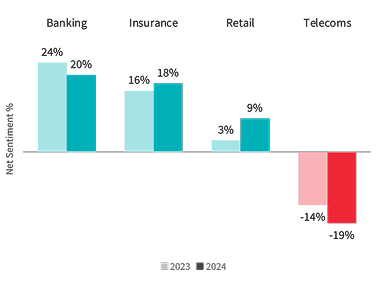

Having tracked over three million social media posts about African Bank, Absa, Capitec Bank, Discovery Bank, FNB, Nedbank, Standard Bank and TymeBank from 1 September 2023 to 31 August 2024, this year’s index sees the industry continue to improve its Net Sentiment maintaining it’s position as SA’s most positively spoken about industry according to consumers on social media.

Despite a decline of 4pp (percentage points) since 2023,

banking maintained its position as SA's most loved industry according to consumer feedback.

Discover the key factors that are impacting customer sentiment toward SA's leading banks